🚀 Trade Intelligently with Your Existing Portfolio

Unlock the power of algo trading using your pledged stocks & mutual funds to generate consistent, risk-adjusted returns in Futures & Options.

Features

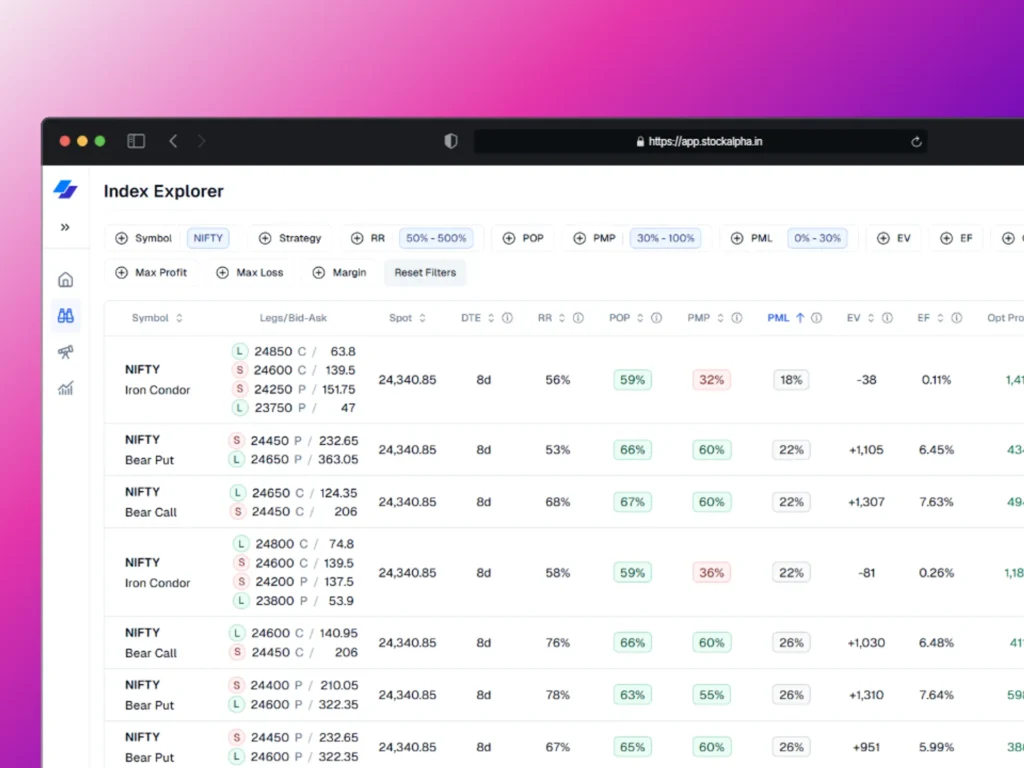

Algo-Driven Precision

Rule-based trading strategies eliminate emotions and bring discipline to your trading journey.

Leverage Existing Assets

Use margin against your stocks or mutual funds without needing extra cash.

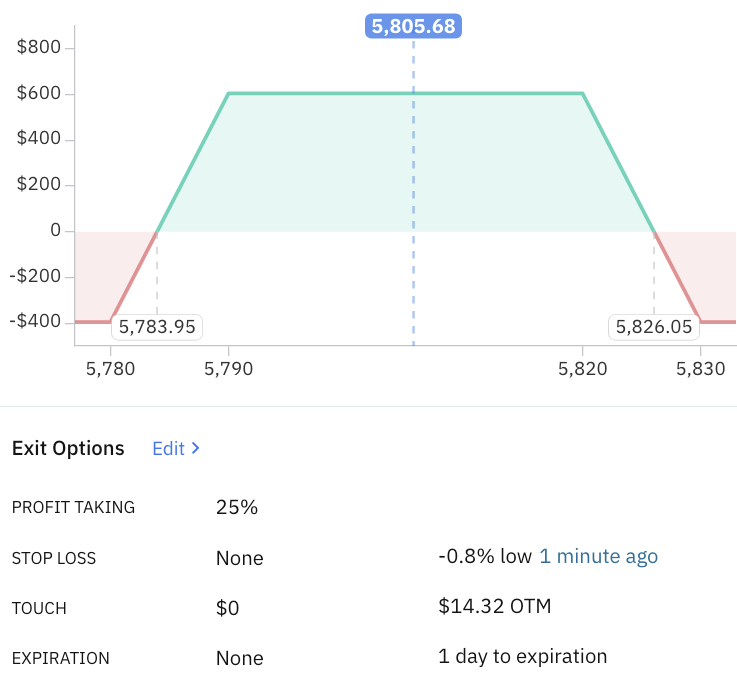

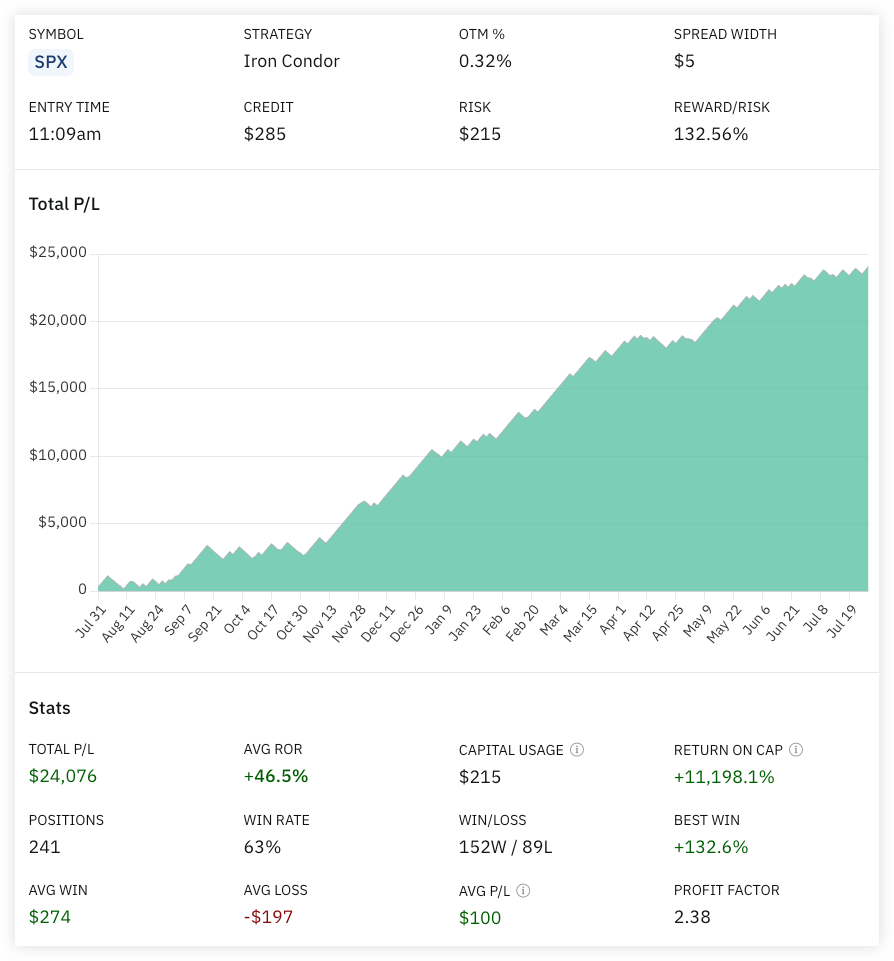

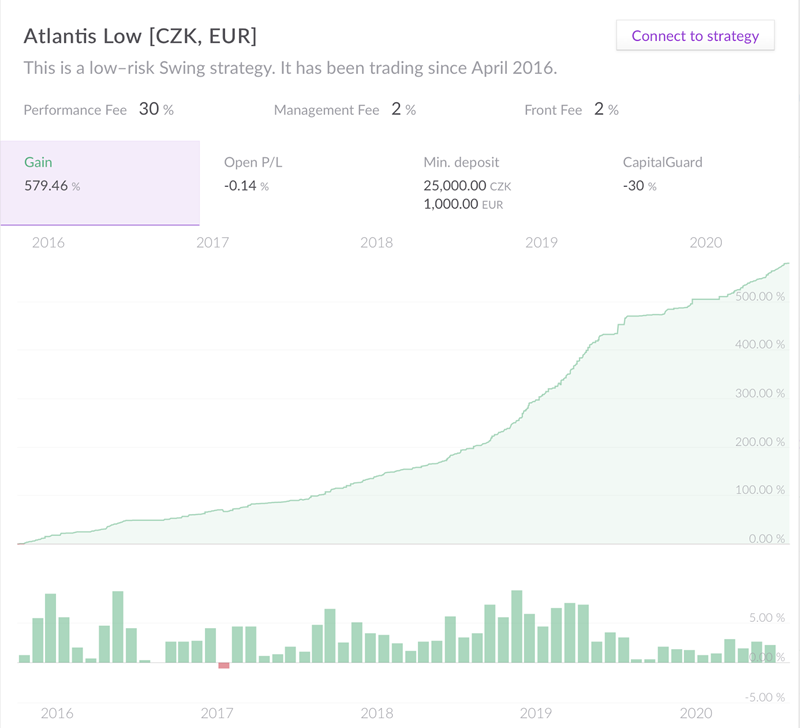

Risk-Adjusted Returns

Our approach focuses on stability, not speculation — balancing returns with controlled risk.

Futures & Options Expertise

Specialized in derivatives, enabling hedging, arbitrage, and income-generation strategies.

How It Works

Pledge Your Holdings

Pledge your stocks or mutual funds to avail margin from your broker.

Connect with TRADEi

Our algo strategies integrate seamlessly with your brokerage account.

Trade Intelligently

Automated F&O strategies execute for consistent outcomes.

Monitor Performance

Track returns in real time with detailed insights & reports.

Why TRADEi?

- Algo-Driven Precision – Rule-based trading strategies eliminate emotions and bring discipline to your trading journey.

- Leverage Your Existing Assets – Use margin against your stocks or mutual funds without needing extra cash.

- Risk-Adjusted Returns – Our approach focuses on stability, not speculation. The strategies are built to balance returns with controlled risk.

- Future & Options Expertise – We specialize in derivatives, enabling you to benefit from hedging, arbitrage, and income-generation strategies.

- Transparency & Control – You remain in charge of your portfolio. We only optimize your margin to generate additional returns.

Our Edge

Proven Quant Strategies

Built on data, backtesting, and live performance.

Capital Efficiency

Generate additional returns without liquidating your core holdings.

Smart Risk Management

Stop-loss, hedging, and diversification baked into every strategy.

Institutional-Grade Tech

Fast, reliable, and scalable algo infrastructure.

Who Can Benefit?

Long-Term Investors

Earn additional income on idle portfolios.

HNIs & Retail Investors

Optimize capital without increasing risk exposure.

Family Offices & Wealth Managers

Enhance client returns with structured strategies.